THE CHALLENGE

Beyond Providing Tools, Bridging the Knowledge Gap

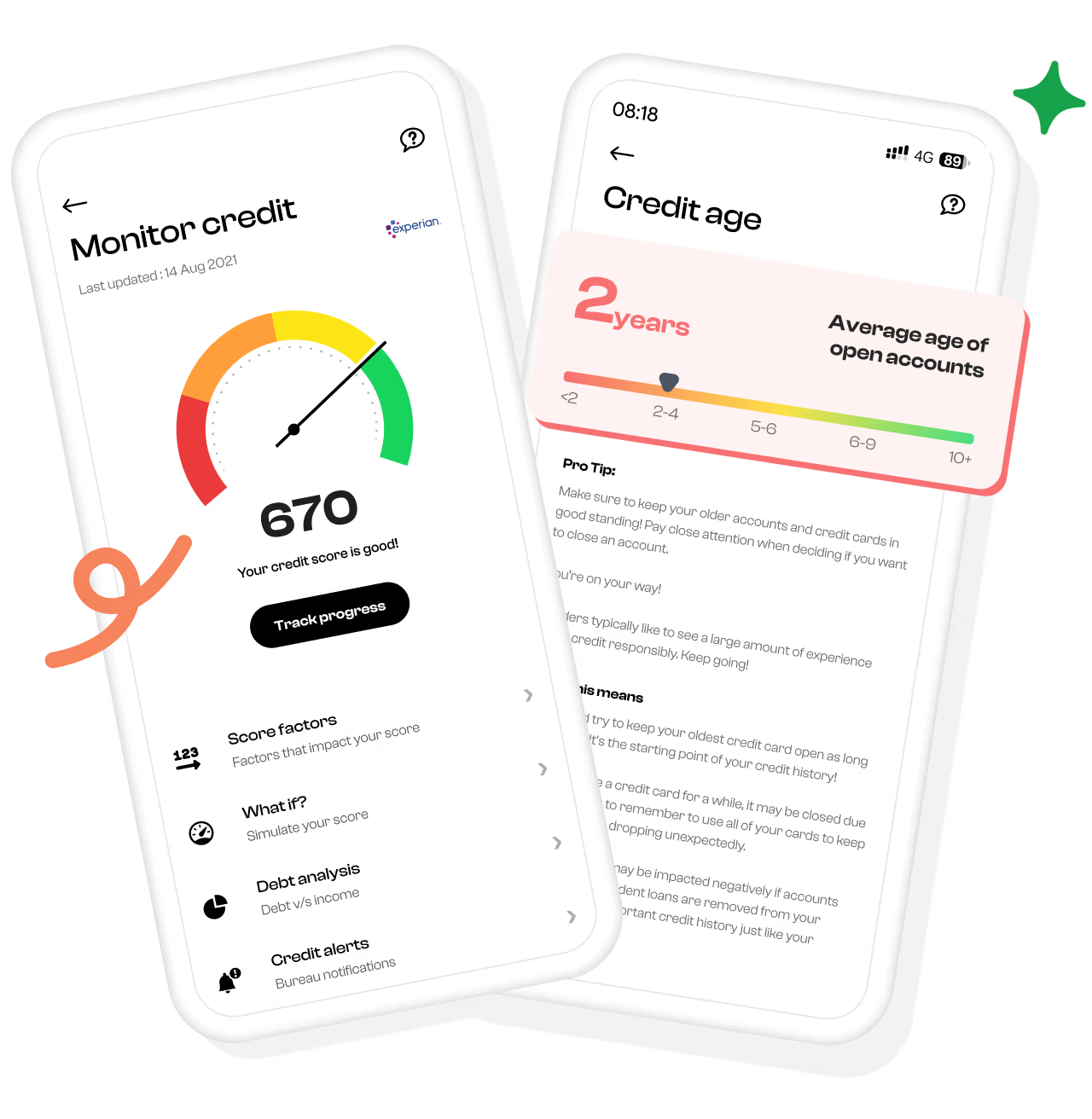

While Beem's AI Super App provided a powerful toolset, the company recognized a critical challenge—the lack of user awareness and guidance around their own credit history and profile.

Many users, particularly those without a traditional credit history, lacked the knowledge to take advantage of the resources available to them. Existing credit monitoring solutions were often reactive, requiring users to seek out information on their own, and were untimely as well. There was a need for a proactive approach that empowered individuals to understand their financial health and take control promptly.